tax is theft bitcoin

New York defines bitcoin sales tax the same way by finding the value of the cryptocurrency or CVC used at the time of purchase and applying that to the value of the CVC amount spent. If you owned your bitcoin for more than a year you will pay a long-term capital gains tax rate on your profit which is determined by.

If cryptocurrency such as Bitcoin is stolen by hackers tax relief may also be available.

. In all cases organized books and records are a necessity. Cryptocurrency Is Treated As Property. However theft losses were also affected in the tax reform.

Crypto theft and scams are on the rise but only some of these losses are tax-deductible. Single taxpayers making between 41676 and 459750 will pay 15 and single. Similarly theft losses used to be tax deductible.

If you have suffered losses as the result of theft. Bitcoins classification as an asset makes its tax implications clear. Tax is theft bitcoin Sunday June 26 2022 Edit.

Unfortunately in most cases you wont. BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. The question here is if you can deduct the losses at your cost basis when your coins were stolenhacked from exchanges or wallets.

Tax Rules for Bitcoin and Others. Lets take a look at how to report stolen scammed and lost tokens on your taxes. They are now no longer tax deductible.

So if youve lost your crypto. Now he admitted that for the higher tax brackets the amount added by the company doesnt compensate for your entire tax burden but at lower levels it accounts for. In all cases organized books and records are a necessity.

The tax code only allows you to write-off a portion of your theft loss as opposed to the full amount. Lost Wallet Access Sent to Wrong Address Theft Loss - ex. If you look at Bitcoins pricing data on Google Finance it only goes back to Nov.

If cryptocurrency such as Bitcoin is stolen by hackers tax relief may also be available. To arrive at the deductible amount 100 plus 10 of your Adjusted Gross. Under the current tax law this situation is a personal casualty loss which is no longer tax-deductible.

Sometimes-- often even-- the taxes are ineptly constructed and cause additional damage through the market distortions they create sometimes their construction excessively invades your. 2 hours agoBitcoins Early Years. For instance single taxpayers making up to 41675 will pay no long-term capital gains taxes.

The growth in BTC adoption in the early years started slow. If you have suffered losses. ExchangeWallet Hacked Stolen Coins Investment Loss - Gray area ex.

Unfortunately worthless ICO tokens may be treated as capital losses not theft losses even more so if SEC has the intent to classify some of these tokens as securities. The IRS has made it mandatory for taxpayers to report bitcoin. Casualty Loss - ex.

The short answer to that question is yes.

Bitcoin Daily Gemini Insurance Bithumb Taxes Pymnts Com

Tax Pros Warned Of New Identity Theft Threats Cpa Practice Advisor

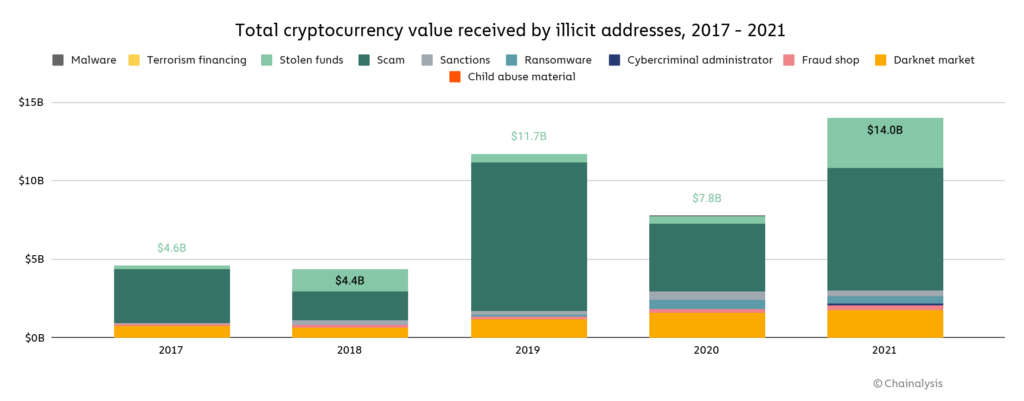

Crypto Crime Trends For 2022 Illicit Transaction Activity Reaches All Time High In Value All Time Low In Share Of All Cryptocurrency Activity Chainalysis

Cryptocurrency Taxes How To Report Lost Or Stolen Coins

.jpg)

How To Report Lost Stolen Scammed Cryptocurrency On Your Taxes Coinledger

Do You Pay Tax On Lost Stolen Or Hacked Crypto Koinly

Dan Held In Nyc On Twitter Taxation Is Theft Inflation Is Theft Bitcoin Is Saving Twitter

Irs Seized 3 5b In Crypto Related Fraud Money This Year As Illicit Activity Multiplies

Cryptocurrency Taxation Here S What You Need To Know Cnn Business

Crypto Taxes How To Calculate What You Owe To The Irs Money

Uk Cryptocurrency Tax Guide Cointracker

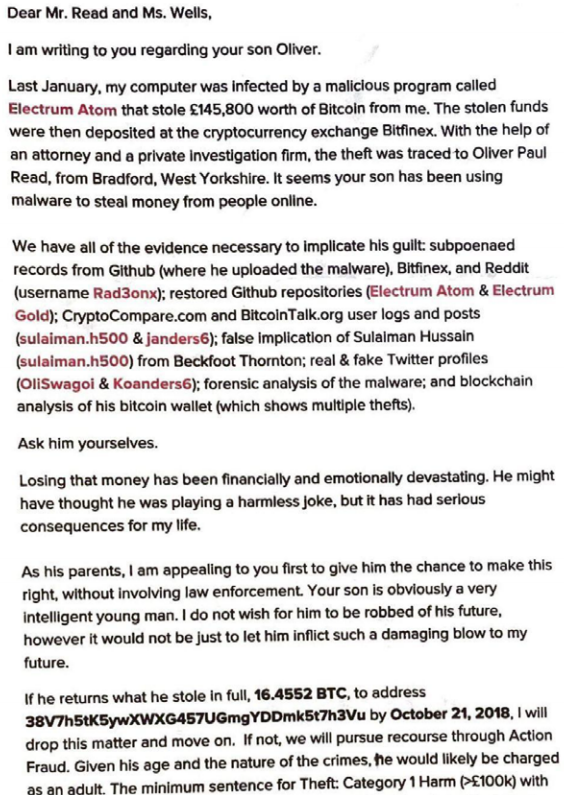

Man Robbed Of 16 Bitcoin Sues Young Thieves Parents Krebs On Security

Taxation Is Theft Archives Bitcoin News

What Tax Preparers Need To Know About Digital Currency

Ransomware And Bitcoin Tax Troubles Frost Brown Todd Full Service Law Firm

Taxation Is Theft Archives Bitcoin News

2022 Ultimate Crypto Tax Guide Defi Cefi And Nfts Accointing Crypto Blog Knowledge Crypto Taxes Guides Tips